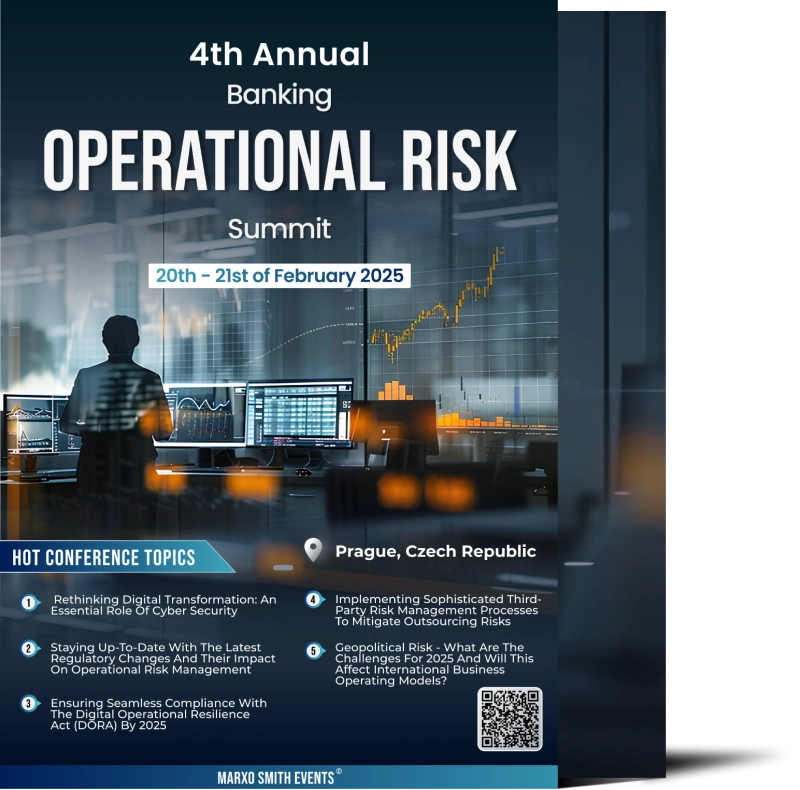

5th Annual

Banking

Operational Risk

Summit

To be announced!

(Time Zone: CEST)

Join us in-person or online

2 DAYS CONFERENCE

The Event!

Do not miss! Event will start in:

Once again we are delighted to welcome you along with our top speakers from the industry to discuss the most compelling content available that non-financial risk is facing at the moment.

At our 5th Annual Banking Operational Risk Summit you will have an opportunity to explore a wide range of sessions including workshops, case studies, round-table discussions, panel discussions, Q&A sessions etc.

The summit will be held in a hybrid format, (in-person and online). We strongly encourage you to join us physically so you do not miss the networking opportunities over coffee breaks, cocktail reception, lunches, etc. where you will have a possibility to meet and discuss with decision makers from the industry.

We will be looking forward to meeting you at our event!

Key Topics

– Rethinking digital transformation: An essential role of cyber security

– Staying up-to-date with the latest regulatory changes and their impact on operational risk management

– Ensuring Seamless Compliance with the Digital Operational Resilience Act (DORA) by 2025

– Implementing sophisticated third-party risk management processes to mitigate outsourcing risks

– Geopolitical risk – What are the challenges for 2025 and will this affect international business operating models?

Some Of Our Previous Speakers

“get inspired from the world’s leading experts”

Who Should Attend

CROs, CEOs, CFOs, COOs, VPs, MDs, Global Heads, Directors, Department Heads and International Managers from Banking industry involved in:

- Operational Risk

- OpRisk Management

- Reputation Risk

- Risk Appetite

- Risk Compliance

- Risk Control

- Risk Measurement

- Risk Methodology

- Risk Reporting

- Security

- Third Party Risk

- Audit

- Behaviour Risk

- Compliance

- Conduct Risk

- Cyber Risk

- Enterprise Risk

- Financial Crime

- Fraud

- Governance

- IT Risk

- Non-Financial Risk

Companies you will meet

Sponsors & Exhibitors are Welcome

Get 20% off Now!

Share 3 of your Main Challenges

Sponsorship opportunities

If you are looking to build awareness of your brand in the banking industry, it doesn’t get bigger than the “5th Annual Banking Operational Risk Summit”.

Marxo Smith sponsorship opportunities provide your organisation with substantial international exposure, increasing visibility of your brand and your networking capacity. We have a sponsorship package suitable for you, no matter how big or small your budget..

Download the program to see how you can get involved.

PREVIOUS EVENT SPONSORS

Implement Consulting Group

How can organisations become truly fit for humans and fit for the future? More competitive, adaptable and sustainable – and more innovative, engaging and entrepreneurial?

We believe it calls for an uncompromising combination of deep functional and transformational expertise. It also calls for a certain mindset: that all change starts with people and that consulting is, in essence, helping. And it demands we work in small, agile teams committed to creating impact together with our clients.

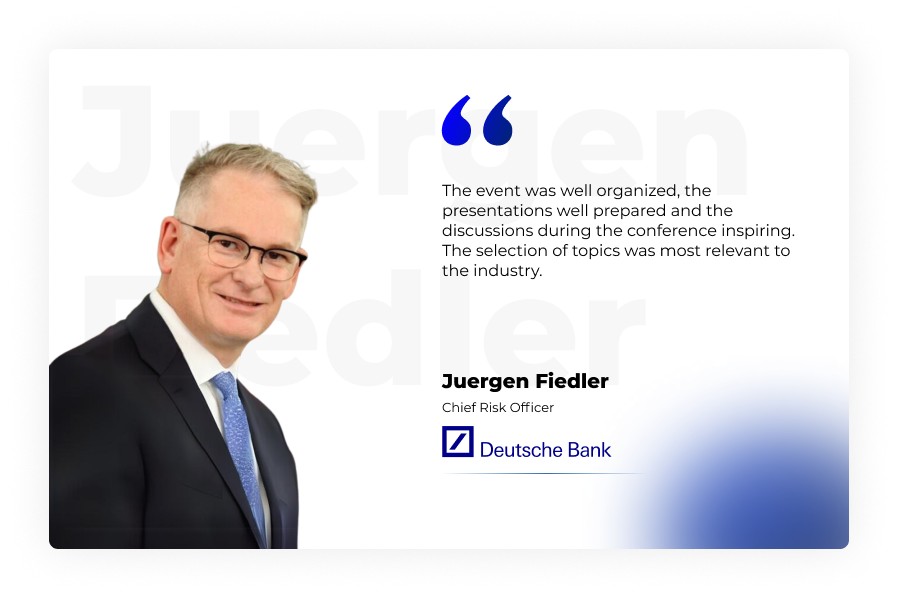

WHAT OUR ATTENDEES HAD TO SAY

Request The Event Brochure!

venue

To be announced soon!